does north carolina charge sales tax on food

In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax. Do you charge sales tax on shipping in North Carolina.

States With Highest And Lowest Sales Tax Rates

Candy however is generally taxed at.

. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. Four states Hawaii Idaho Kansas and Oklahoma tax groceries at the regular sales tax rate but offer credits or rebates offsetting some of the tax for some parts of the. However separately stated charges for installation services are excluded from sales tax.

North Carolina taxes delivery charges. Grocers in particular should note that tax applies to sales of hot prepared food products as provided in Regulation 1603 e. The sale of food at retail as defined in NC.

Groceries and prepared food are subject to special sales tax rates under North Carolina law. Certain out-of-state sellers will have to start collecting and remitting North Carolina sales tax as of November 1 2018. Ergo they are food.

The 475 general sales rate tax plus local taxes including the transit and Article 46 sales tax are charged on purchases of non-qualifying food The reduced 2 local tax rate is charged on qualifying food which includes groceries and bakery items sold without eating utensils. This general rate applies to food prepared and consumed on the premises of full service restaurants and other retail establishments such as taverns and fast food shops that serve food. 105-1643 is subject to the 2 rate of tax.

Prescription Medicine groceries and gasoline are all tax-exempt. Indiana has state sales tax but does not have local sales tax. These items exclude unhealthy foods like sodas and candy.

675 Is this data incorrect Download all North Carolina sales tax rates by zip code. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. 105-1641326b provides an exemption from sales and use tax for food prepared food soft drinks candy and other items of tangible personal property sold not for.

Even if separately stated delivery charges are subject to sales tax. A north carolina business cannot charge a higher sales tax on groceries as it does on sodas. 3 rows But North Carolina does charge the 2 or 225 percent local sales tax on qualifying.

The sale of prepared food is subject to general State rate of tax of 475 and the applicable local and transit rates of sales and use tax as applicable. Candy is subject to the combined state and local sales tax rate. We recommend businesses review the laws and rules put forth by the NCDOR to stay up to date on which goods are taxable and which are exempt and under what conditions.

Kit Kats contain flour. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. With local taxes the total sales tax rate is between 6750 and 7500.

Some goods are exempt from sales tax under North Carolina law. All shipping handling transportation and delivery charges imposed by the retailer that are in any way connected with the sale of taxable tangible personal property certain digital property and certain services for storage use consumption or otherwise sourced to the State are subject to the North Carolina. The State of North Carolina charges a sales tax rate of 475 Counties and municipalities in North Carolina charge additional sales tax with rates between 2 and 275 for.

Arkansas cut its rate to 0125 percent from 15 percent in 2019. According to statute as recodified and rewritten effective January 1 2004 the definition of sales price includes delivery charges. 53 rows Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Tax does not apply to sales of food products for human consumption except as provided in Regulations 1503 1574 and 1603. Certain Sales at School Sponsored Events Exempt NC.

Examples include most non-prepared food items food stamps and medical supplies. Does North Carolina charge sales tax on out of state sales. While South Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

This page describes the taxability of food and meals in South Carolina including catering and grocery food. In most states necessities such as groceries clothes and drugs are exempted from the sales tax or charged at a lower sales tax rate. See Figure 3 Most recently Tennessee cut its sales tax on food to 4 percent from 5 percent in 2017.

The transit and other local rates do not apply to qualifying food. Business Registration Exemption Reporting and Remitting Tax. Semantics aside in North Carolina.

Goods that are subject to sales tax in North Carolina include physical property like furniture home appliances and motor vehicles. Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and. The Craven County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Craven County local sales taxesThe local sales tax consists of a 200 county sales tax.

To learn more see a full list of taxable and tax-exempt items in South Carolina. Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in research and development. Some services in North Carolina are subject to sales tax.

However products that supplement and replenish. North Carolina doesnt collect sales tax on purchases of most prescription drugs. Food and food ingredients excluding alcoholic beverages and tobacco are subject to a lower rate of 2.

The purchaser will collect tax when the items are resold. North Carolina reduces the sales tax rate to just 2 for qualifying grocery items like fruits vegetables meats and snacks.

What Canadian Businesses Need To Know About U S Sales Tax Madan Ca

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Shipping Sales Tax In 2021 Taxability Examples Laws More

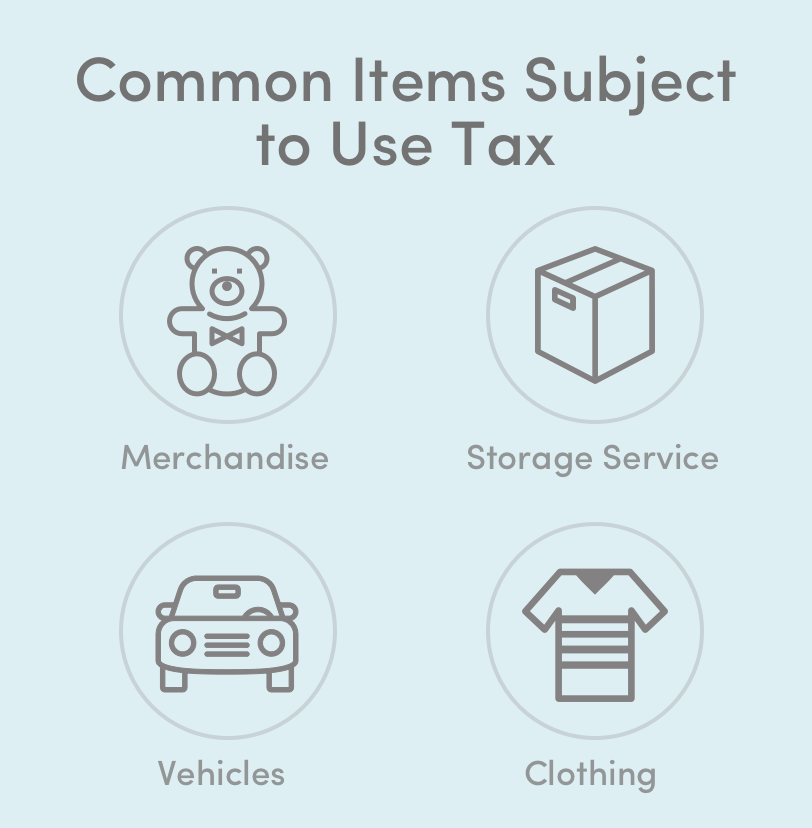

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

Is Food Taxable In North Carolina Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Home Depot Sales Tax On Tool Rental Home Depot Sales Home Tools Rental

Ja Vie Comfy Jelly Knit Flats Size 9 Free Shipping In 2022 Nebraska Nevada Connecticut

Gecko 9916 101335 7 Button 3 Output Overlay For In K450 3op Free Shipping In 2022

Vintage Nabisco National Biscuit Company Shredded Wheat Tin Yummy Biscuits Nabisco Wheat Biscuits

Is Food Taxable In North Carolina Taxjar

States Without Sales Tax Article

Sales And Use Tax What Is The Difference Between Sales Use Tax

Baabuk Urban Wooler Sneaker Light Grey Orange Eu 39 M Us 7 M Free Shipping Ebay In 2022 Nebraska Urban Nevada

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

How To Register For A Sales Tax Permit Taxjar

Sales Tax On Grocery Items Taxjar