inheritance tax waiver nc

No Inheritance Tax in NC. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Washington has the highest estate tax at 20 applied to the portion of an estates value greater than 11193000.

. Income Tax Rate Indonesia. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. Restaurants In Matthews Nc That Deliver.

A legal document is drawn and signed by the heir waiving rights to. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. What is inheritance tax waiver form.

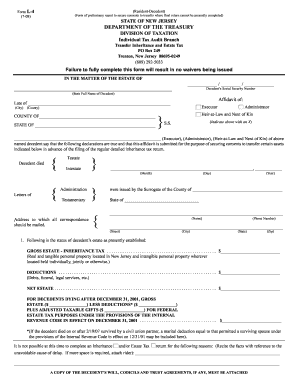

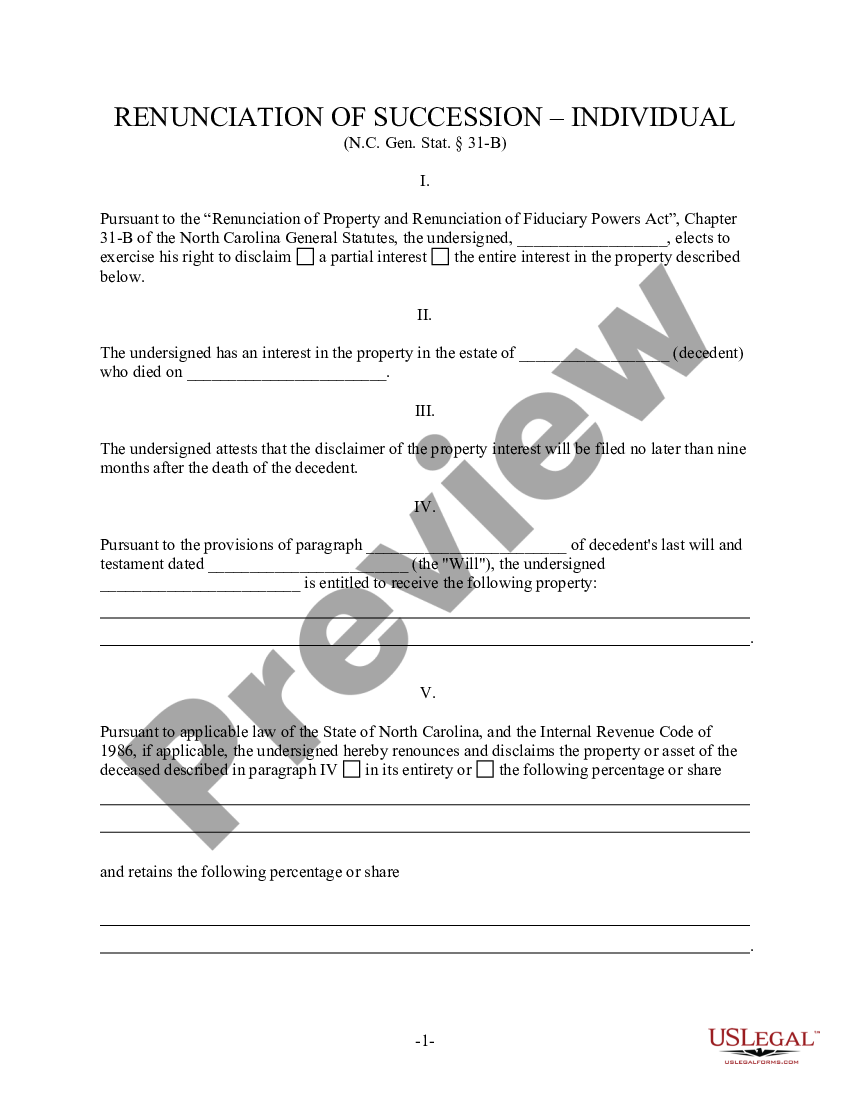

For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212. Inheritance tax waiver form nc. I the personal representative in the above estate.

According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island and Tennessee. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. PO Box 25000 Raleigh NC 27640-0640.

However this policy still applies to any of those taxes due prior to their repeal. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. The inheritance tax is paid.

When you are receiving an inheritance you may wonder if you are required to pay a tax on the inheritance. Important Notices and Frequently Asked Questions. Opry Mills Breakfast Restaurants.

There is no inheritance tax in North Carolina. When an heir is notified of their inheritance they should carefully review assets in light of their unique tax situation with a North Carolina tax lawyer. In 2021 federal estate tax generally applies to assets over 117 million.

These are some of the taxes you may have to think about as an heir. Essex Ct Pizza Restaurants. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

Income Tax Return for Estates and Trusts each year that the trust has 600 in income or has a non-resident alien as a beneficiary. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. After the first spouse dies the estates executor.

Tax Bulletins Directives Important Notices. North Carolina Department of Revenue. STATE OF NORTH CAROLINA County NOTE.

Further married couples can utilize what is known as the portability option to effectively double this amount. You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. Inheritance Tax Waiver Form Nc.

Situations when inheritance tax waiver isnt required. North Carolina Judicial Branch Search Menu Search. There is no inheritance tax in north carolina.

Trusts must file a Form 1041 US. 28A-21-2a1 is not required for a decedent who died on or after 112013. Use this form for a decedent who died before 111999.

However there are sometimes taxes for other reasons. North Carolina Inheritance Tax and Gift Tax. Inheritance And Estate Tax Certification.

All groups and messages. Only six states impose an inheritance tax but who has to pay inheritance tax varies from state to state and tax rates can range from 1 up to 16. There is no inheritance tax in nc so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

There is no gift tax in North Carolina. Soldier For Life Fort Campbell. By North Carolina Judicial Branch.

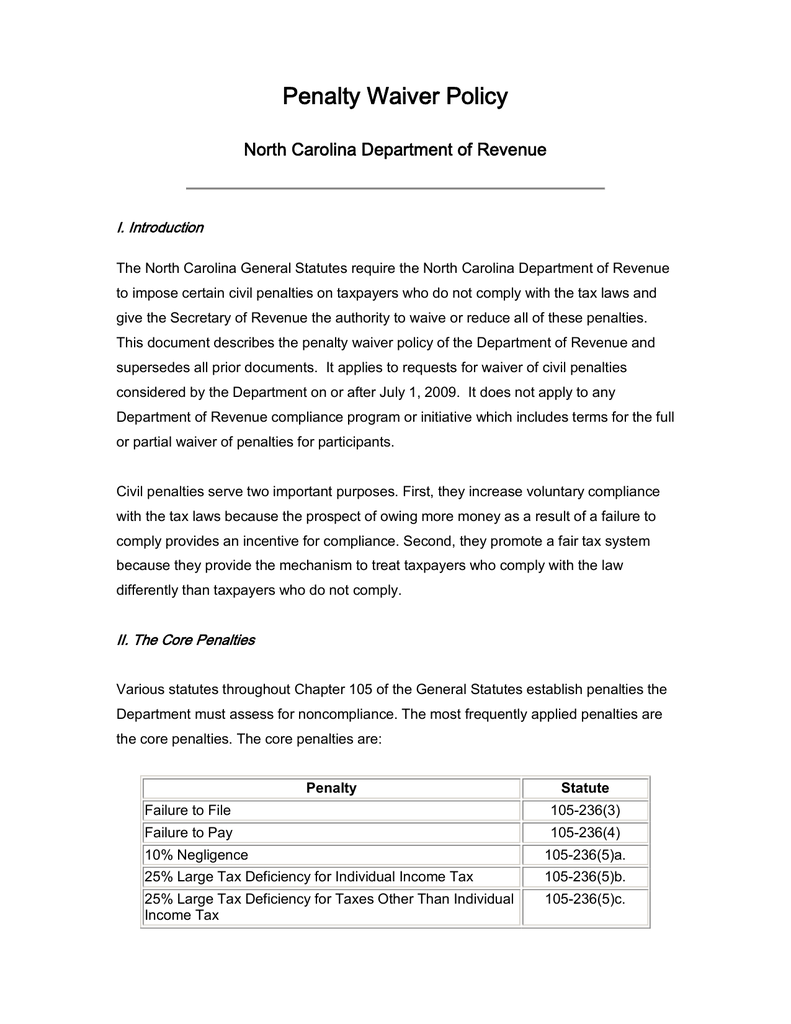

Tax implications depend on the type of asset the value and other factors. An inheritance tax waiver is required by brokers in order to transfer stock ownership of a deceased person from hisher name into the new account which contains herhis estate assets. Inheritance estate gift and the unauthorized substances taxes1 the good compliance reason in the general waiver criteria does not apply to these taxes because these taxes lack the compliance history that is the basis of the good compliance reason.

Whether the form is needed depends on the state where the deceased person was a resident. North Carolina does not collect an inheritance tax or an estate tax. There is no inheritance tax in NC.

Individual income tax refund inquiries. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Delivery Spanish Fork Restaurants. New Hampshire New Mexico North Carolina Oregon South Carolina Texas Utah Vermont Virginia Washington Wisconsin Wyoming. While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance.

An estate tax certification under GS. The New York inheritance tax exemption is very different. Mangum St 6th Fl Durham NC 27701.

Find a courthouse Find my court date Pay my citation online. Inheritance Tax Waiver Nc. There is no federal inheritance tax but there is a federal estate tax.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. Inheritance Tax Waiver Nc. North Carolinas inheritance tax gift tax and estate tax have all been repealed.

The waiver form is expected to federal government with north carolina inheritance tax waiver to federal income. Some states still charge an estate tax death tax. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million.

The new amount helps many people avoid the inheritance tax which can be as high as 40 on amounts over 11180000.

Federal Gift Tax Vs California Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Waiver Of Personal Representatives Bond E 404 Pdf Fpdf Doc Docx North

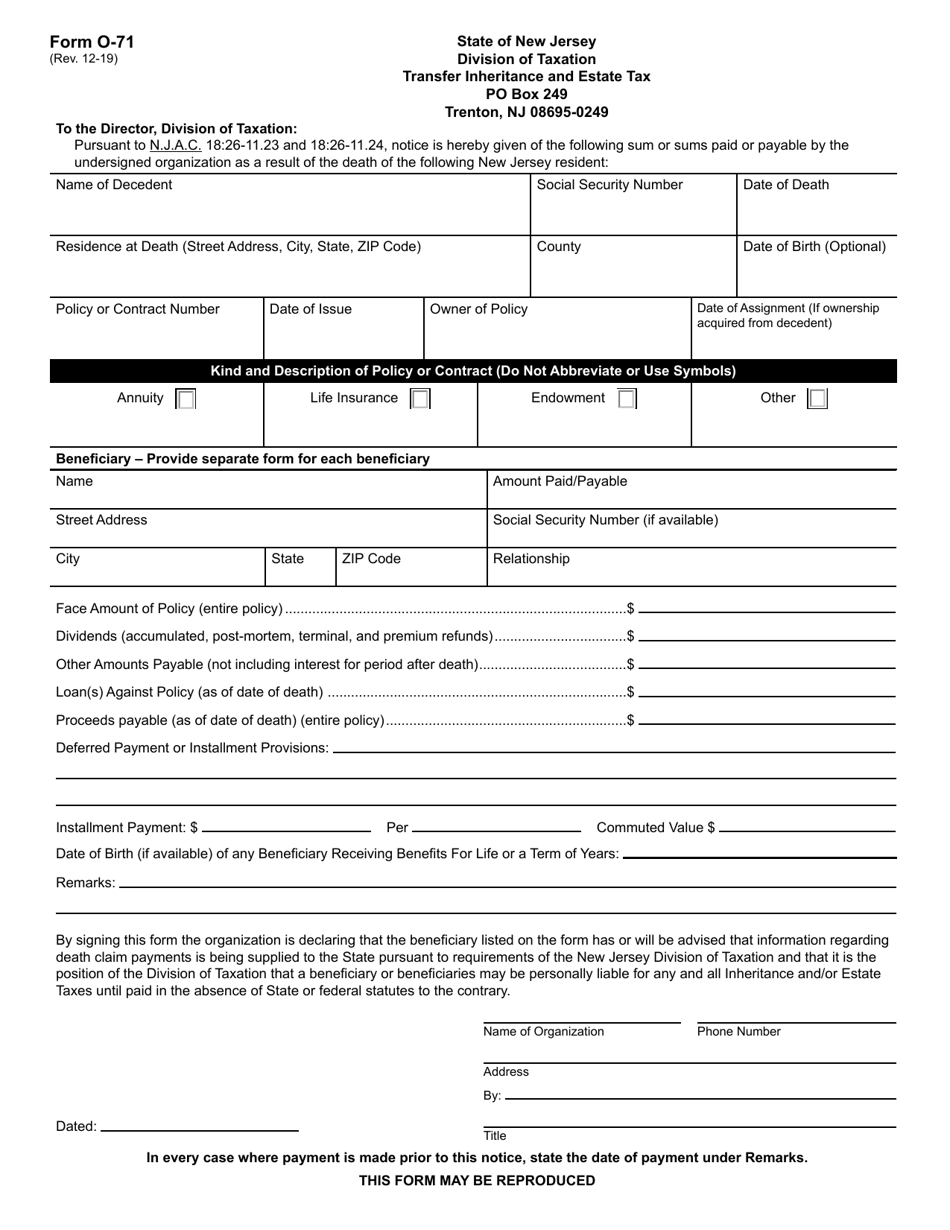

Nj Inheritance Waiver Tax Form 01 Pdf Fill Online Printable Fillable Blank Pdffiller

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Penalty Waiver Policy North Carolina Department Of Revenue

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

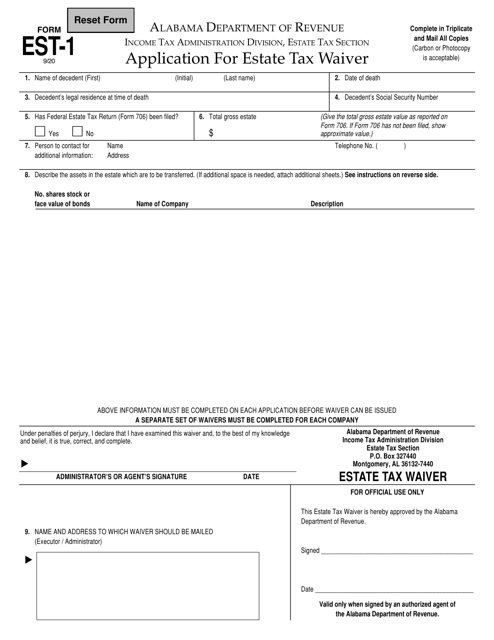

Form Est 1 Download Fillable Pdf Or Fill Online Application For Estate Tax Waiver Alabama Templateroller

Form O 71 Download Fillable Pdf Or Fill Online Transfer Inheritance And Estate Tax New Jersey Templateroller

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Templates Tax Forms

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Nc Us Legal Forms

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Nc Us Legal Forms

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition